How to Navigate 4 Key Sporting Goods Industry Trends and Reverse Slowing Sales

Sporting goods retailers in the United States entered 2024 looking to reverse a troubling decline in sales.

In its 2024 Outdoor Retail Sales Trends Report, the Outdoor Industry Association (OIA) learned that total retail sales in 2023 had dipped to $27.5 billion. Not a bad number, but it marked a 3.2% decline from 2022’s totals.

There are some bright spots. Even though sales of apparel — a major product category in OIA’s report — declined in 2023, another report from software company ENDVR projects it to grow by $6.53 billion between now and 2028.

As a sporting goods business owner, though, it’s unlikely that focusing on outdoor apparel alone will be enough to steady the ship in the coming years. True business stability will require a diversified focus that includes the following four sporting goods industry trends, as well.

The sooner you react to these emerging trends, the sooner you can respond to consumer preferences and boost customer loyalty.

#1: Increased pricing sensitivity

Pricing sensitivity is a measurement of how much the price of goods and services affects consumer demand for them. It’s especially problematic when inflation is high and consumers have less disposable income.

For example, suppose you increase the price of a popular brand of tennis racquet by $5. If sales crater and a lower-priced brand takes its place, you’re dealing with high price sensitivity.

Pricing sensitivity can strike any retail category, but in recent years it’s hit outdoor retail particularly hard. In fact, in a 2024 interview with ISPO, Jeff Carter, who is director of merchandising for US sporting goods merchant Mast General Store, said, “What we have noticed in the last 18 months is a price sensitivity among customers that we have never experienced before.”

Carter explained that customers have been forced to rethink the types of products they purchase, as well as the quantity. As a result, Mast General Store has expanded its product offering to include more products at entry-level pricing. “We have had to reposition some brands and look for brands in the lower price segment to show our guests that we have something for everyone,” he said.

Besides offering a wider array of products to keep your price-conscious customers in the fold, combat pricing sensitivity by building value into your more expensive items.

Bundle items to convey incremental value

Shoppers in the market for golf clubs will likely need golf balls and a bag, too. When you bundle these items together and sell them at a discount, you can accomplish three things:

- Customers think they’re getting more for less, incentivizing them to buy.

- You save customers the time of shopping for the items individually.

- Your per-item profit margins may take a hit. But that shouldn’t matter too much because you’ll compensate by selling more premium products than you would otherwise and potentially increase average order value.

Here’s a possible golf-themed bundle:

- Club: $150 retail, $140 bundled

- Balls: $15 retail, $10 bundled

- Bag: $40, $35 bundled

If a customer buys each of these separately, they’d pay $205. Bundled together, they’d pay $185.

To price bundles correctly, nail down your gross margins on the products in the bundle. Then decide how deeply you’re willing to undercut those margins based on the expectation of selling more units at the discounted price.

Here’s a rule of thumb: If your average margins are more than 50%, discount up to 20%. For average margins less than 50%, discount 5% to 10%.

Experiential in-store merchandising

Another way to showcase the value of premium items is to set up experiential merchandising displays in your physical stores.

Once consumers get to use and experience these higher-priced products, they’re more likely to understand why these items cost a few dollars more. The higher price might come from superior performance, materials, or durability.

For example, set up an expensive tent inside your store so customers can get a sense of its size and shape. Fill it with complementary camping items you sell like sleeping bags, lanterns, and portable stoves.

If you cater to golfers, set up a small putting green where customers can try out your premium clubs.

Include shipping protection for ecommerce items

Shipping protection safeguards packages against theft, loss, or damage during transit. When you offer shipping protection, you give buyers the peace of mind that you’ve protected their investment.

Shipping protection from Extend costs only a fraction of the product’s price.

Customers ordinarily pay for shipping protection. But you could bundle it with the price of the item to boost the perceived value of the product and create added buying confidence.

#2: Demand for sustainable (but durable) products

It’s no surprise that fitness enthusiasts want to protect the outdoors. For many of them, having a positive impact on the outdoors starts with purchasing sustainably produced sporting goods.

Even with the pressures of inflation, pricing sensitivity, and cost-of-living increases, many consumers are still willing to pay more for sustainably produced or sourced goods. PwC’s 2024 Voice of the Consumer survey puts that number at 9.7% more, on average.

Just because some consumers are willing to pay more for sustainable sporting goods doesn’t mean these items are automatically more expensive than their non-sustainable alternatives.

Take Patagonia’s Ahnya Fleece Pullover for women. Made from “57% Regenerative Organic Certified® cotton” and “38% recycled polyester,” the pullover’s suggested retail price is less than $100.

But before you rush to stock competitively priced, sustainable goods that you can just mark up, remember that these products must also be durable.

According to Marco Redini, CEO of the outdoor retail brand UYN, “New fibers must perform as well as, if not better than, traditional synthetic fibers derived from fossil fuels.”

In other words, while some consumers are willing to pay more for a sustainably produced tent, the tent can’t start fraying after only a few camping trips.

#3: Continued risk of overstock

Overstock is excess inventory that takes up precious space in warehouses. It drives up warehousing costs, and it’s a nagging trend in the sporting goods sector.

An early 2024 study from the World Federation of the Sporting Goods Industry showed how widespread this trend still is. It found that “around 80% of the 85 respondents said they had a higher inventory peak than a year ago, with more than half saying overstocking was likely to be a ‘persistent problem.’”

Overstocking is often the result of poor demand forecasting, a process made more difficult by the number of key factors you must weigh to get accurate results. Those factors include:

- Historical sales data: Past sales help identify future trends for the forecast period.

- Consumer behavior data: There might be a growing demand in the market for fitness activities like pickleball and less demand for tennis.

- Economic indicators: High unemployment and inflation can affect customer willingness to buy.

- Competitor activity: If a competitor lowers prices on similar goods or launches new, innovative products, you might see less demand for some of your items.

- External factors: A war or strike can disrupt maritime movements, immobilizing supply chain activity.

Demand forecasting software powered by artificial intelligence (AI) can save you time and make the process more efficient. For example, Leafio uses AI to analyze data sets and generate a more accurate forecast of inventory needs.

While Leafio is suitable for smaller outdoor retail companies, implementation of the software may take about six months. But if the payoff is reduced warehousing costs and always having the products your customers want in stock, the wait might be worth it.

#4: Declining ecommerce sales

Another sporting goods industry trend is a decline in online retail sales after the pandemic-era boom.

According to the OIA study cited earlier, “Retail Ecommerce, the smallest of the three channels at $2.9 billion, saw a 7.5% decline in sales over 2023, an 8.3% decline in units sold, and a slight increase in average sales prices.”

This sales decline may be due (at least partially) to customers shopping more frequently on Amazon and at big box retailers following the pandemic as well as high inflation. But it’s also due to an evolution in what consumers want from the ecommerce experience. Here are some actionable ways to keep up with that evolution:

Buy online, pick up in store (BOPIS)

Inflation-weary consumers look to save money however they can. BOPIS frees them from having to pay shipping costs and gives them a convenient way to return products that don’t meet expectations.

Granted, BOPIS only works if you have a network of physical retail stores. And if you do, the BOPIS trend is worth considering because it’s still gaining ground with consumers. A Research and Markets study projects a compound annual growth rate of 11.57% for BOPIS-related sales between now and 2028.

While shifting to BOPIS might require some store reconfiguration to allow for easy pickup of items, you likely won’t need to switch ecommerce providers. Key players like BigCommerce have APIs that help you create custom, brand-specific BOPIS experiences.

Make the ecommerce experience more interactive

The major drawback of online stores is customers’ inability to touch and try on sporting goods merchandise. Many outdoor retailers are working to bridge this gap, and a handful are seeing their ecommerce revenue jump as a result.

One of these merchants is athletic footwear brand Hoka, whose Q1 2024 “DTC revenue, primarily sales from its ecommerce website, grew by 33%” YoY. This market growth bucks the downward trends highlighted in the OIA report.

So what is the brand doing? First, on their product pages, Hoka includes brief video clips showing a real person moving around in select pieces of apparel. Ecommerce shoppers get a better sense of fit and how the item stretches during workouts, something photos alone can’t quite do.

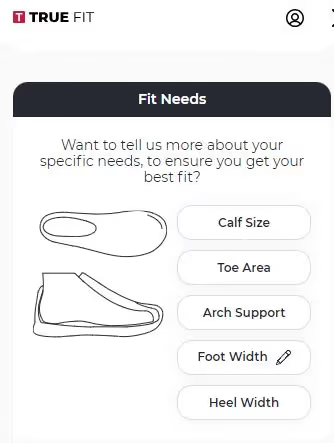

Hoka also offers a free online service called True Fit, which asks shoppers a series of questions in order to match them with the perfect product and size.

Shoppers may not be able to try on the shoe physically, but TrueFit gives them more confidence to buy a pair online.

Add product protection to checkout flow

Modern product protection gives your customers a quick, easy way to repair or replace a product that has suffered accidental damage.

While these plans have a price tag, many customers are willing to pay a bit more for the peace of mind they offer. And since you, the merchant, receive a portion of the revenue from each plan sale, you’re able to boost average order value.

Eyewear brand Felix Gray carries a line of sunglasses perfect for outdoor activities. When the brand added Extend Product Protection to its checkout flow, Felix Gray soon achieved an overall plan attach rate of 19.3%.

This means 19.3% of all Felix Gray orders have an Extend product protection plan attached to them. And not only can customers attach them in a single click, the superior online experience continues when they need to file a claim.

Your customers simply head to Extend, enter their email address and some information about the accident, and Extend’s 24/7 virtual claims assistant Kaley determines next steps. The process takes minutes, not hours.

Increase customer loyalty with Extend Shipping and Product Protection

If you don’t react to increased pricing sensitivity, the rising demand for sustainable products, or the need for better ecommerce experiences, your customers will take their business elsewhere. In other words, any potential loyalty they may have had will evaporate.

Product and shipping protection from Extend can help you meet some of the challenges presented by these trends. Extend not only addresses key customer needs, but the ease and efficiency of the claims experience increases customer loyalty. Customers expect this process to be difficult, so when it’s not, they’ll credit your brand for saving them time.

So if your outdoor retail business sells bikes, e-bikes, e-boards, tents, hunting scopes, or binoculars, consider Extend Product Protection. Shipping protection is available for any item in your inventory.

Click here to get started with a demo of the Extend platform and experience.

Aaron Sullivan is senior content marketing manager at Extend. He specializes in writing about e-commerce, finance, entertainment, and beer.

.svg)